Mortgage arrears have hit their highest level for nearly seven years as soaring interest rates and the cost-of-living squeeze pile pressure on borrowers.

The value of outstanding home loans with arrears climbed by a ‘terrifying’ 13 per cent to £16.9billion in the second quarter of this year, Bank of England figures released yesterday showed.

It was the highest level since the third quarter of 2016 and 29 per cent higher than the same period a year ago and is likely to further fuel calls for the Bank to stop putting up interest rates.

Separate data from the Office for National Statistics showed signs of a downturn in the UK jobs market, with employment numbers falling sharply.

Lewis Shaw, founder of Mansfield-based Shaw Financial Services, told the news agency Newspage: ‘The speed at which mortgage arrears are increasing is terrifying and should give cause to pause at the next Bank of England interest rate meeting.

Squeezed: The value of outstanding home loans with arrears climbed by a ‘terrifying’ 13% to £16.9bn in the second quarter of this year, Bank of England figures released yesterday showed

This is dire data, and we know that it’s about to get an awful lot worse with 1.6m mortgage holders due to renew over the next 12 months at significantly higher rates than anyone has been used to for well over a decade.’

The Bank’s figures reflect the value of outstanding mortgage balances where the borrower has failed to make contracted payments equivalent to at least 1.5 per cent of the outstanding mortgage balance.

It means that 1.02 per cent of total home loans are in arrears, up from 0.89 per cent in the first quarter and the highest rate since the start of 2018.

The figures also showed that the outstanding value of all residential mortgages stood at £1.66 trillion at the end of June, up by 0.4 per cent on a year earlier but a fall of 1.2 per cent on the previous quarter.

It was the biggest such decline since comparable records began in 2007.

The value of home loans advanced in the second quarter – at £52.4billion – was a third lower than a year earlier and signalled the weakest quarter for the mortgage market since the second quarter of 2020 at the height of the pandemic.

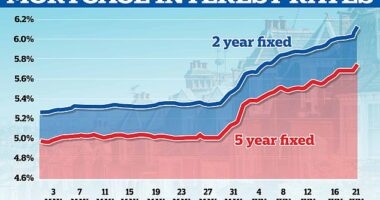

It comes after 14 successive interest rate hikes.

Rates stand at 5.25 per cent and are expected to rise again to 5.5 per cent next week, though Bank of England governor Andrew Bailey has hinted that the increases could soon come to an end.

Simon Gammon, managing partner at Knight Frank Finance, said the ‘vast majority’ of outstanding mortgages were issued under post-financial crisis rules that were more stringent on affordability.

‘While mortgage payments at today’s rates are painful, they are still technically affordable,’ he said.