Who’s ready for the next central bank decision?

Can’t get enough of central banks updating their monetary policies?

The RBNZ is up this week so you better prepare if you plan on trading NZD soon!

Events in Focus:

Reserve Bank of New Zealand Monetary Policy Statement

When Will it Be Released:

August 16, Wednesday: 2:00 am GMT; presser to follow at 3:00 am GMT

Use our Forex Market Hours tool to convert GMT to your local time zone.

Expectations:

- RBNZ is likely to keep its interest rates unchanged at 5.50%

- RBNZ policymakers are expected to follow their counterparts and decide future rate hikes based on emerging data.

Relevant New Zealand Data Since the Last RBNZ Statement:

? Arguments for Tighter Monetary Policy / Potentially Bullish for NZD

CPI up by 1.1% q/q in Q2 2023 vs. 1.2% in Q1, 0.9% expected. Annual CPI dropped from 6.7% to 6.0% in Q2 thanks to lower petrol prices and higher interest rates

ANZ’s business outlook survey showed that a net of 13.1% of respondents expected the New Zealand economy to get worse in July, an improvement of 5 points from June

The unemployment rate ticked up from 3.4% to 3.6% in Q2 2023- a two-year high – as strong labour demand was met with more people looking for work

Quarterly inflation expectations ticked higher from 2.79% to 2.83% q/q, suggesting a potential pickup in price pressures over the next two years

? Arguments for Looser Monetary Policy / Potentially Bearish for NZD

Services PMI fell to 50.1 in June (52.5 forecast) from a revised 53.1 previous read; Employment index fell to 49.1 vs. 52.3 previous; New orders dipped to 51.3 vs. 55.4 previous

Home-building consents dip by 2.6% q/q in Q2, down to their lowest levels since Q3 2020 as higher interest rates and a property slump slowed construction

Westpac sees another rate hike to 5.75% but expects that to “occur in November instead of August.”

Previous Releases and Risk Environment Influence on NZD

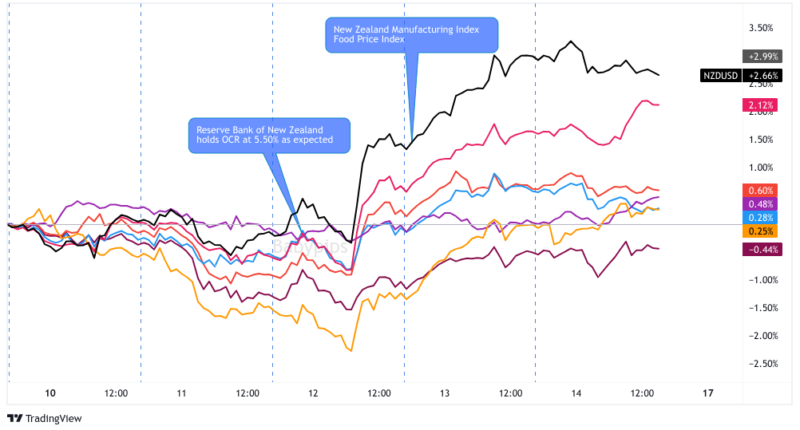

Jul. 12, 2023

Overlay of NZD vs. Major Currencies Chart by TV

Action/results:

As expected, the RBNZ kept its interest rates steady at 5.50% in July. The non-rate hike initially weighed on NZD but the central bank also said that it would keep its OCR at “a restrictive level for the foreseeable future,” at least until CPI “returns to the 1 to 3% annual target range.”

NZD, which was inching higher ahead of the event, hit new Asian session highs before profit-taking ahead of the U.S. CPI report dragged the comdoll and other risky assets lower.

Kiwi still capped the day in the green, though, because the U.S. CPI numbers later that day printed lower and encouraged risk-taking during the U.S. session.

Risk Environment and Intermarket Behaviors:

There was limited volatility at the start of the week as the markets braced for the U.S. CPI report and its impact on U.S. dollar demand.

The CPI and PPI reports fell short of estimates, adding to the cooling inflation narrative and lower odds of interest rates rising much further.

Risk assets overpowered the dollar and caught some points up until Friday when we saw some profit-taking.

May 24, 2023

Action/results:

The RBNZ increased the OCR by 0.25% as expected, but this was mostly seen as a dovish hike since policymakers hinted that interest rates may have peaked.

They even revealed that the committee had a split vote on the decision since some wanted to sit on their hands on account of subsiding inflationary pressures and weaker business conditions on the domestic front.

Not surprisingly, this spurred another leg lower for the Kiwi – which was already on the decline following the downbeat quarterly retail sales released the day prior – that lasted for the rest of the week.

Risk Environment and Intermarket Behaviors:

This trading week was characterized by relatively low volatility, as market players had been holding out for more updates on the U.S. debt ceiling impasse.

Risk-off vibes returned to the markets on Monday when news broke out that debt ceiling negotiations broke down over the weekend, keeping higher-yielders on the back foot.

Concerns about China’s economic rebound and commodity demand weighed on risk assets midweek as well. To top it off, hawkish rhetoric from the FOMC minutes also kept investors wary of recession risks.

It wasn’t until the end of the week that risk appetite picked up, but the Kiwi was barely able to hold on to its intraday gains then.

Price action probabilities

Risk sentiment probabilities: We’ve got a busy week ahead based on the forex calendar, and the top tier event that’s likely to rattle broad risk sentiment around the RBNZ release are the Chinese and U.S. economic updates during the Tuesday U.S. session.

China is currently expected to post improvements to industrial production and retail sales numbers, and if that plays out, we could see risk sentiment flow positive early in the Tuesday session.

U.S. retail sales is the most notable to likely drive broad risk sentiment around the RBNZ release as that update will signal the health of the U.S. consumer sector. But of course, the reaction will likely depend on the degree of difference between the actual read vs. expectations and previous reads.

At the moment, the market expects the U.S. to print retail sales improvement, and if that scenario plays out, that could drive traders to price in expectations of “higher interest rates for longer” which has had an arguably net negative risk sentiment reaction more times than not this year.

New Zealand Dollar scenarios

Potential Base case: Growth concerns in China and New Zealand as well as the lack of significant price pressures may be enough to keep the RBNZ on hold at 5.50% in August.

Like in July, however, the central bank could emphasize its willingness to keep its interest rates high until inflation dips to its target range. A presser about an hour after the statement’s release could also emphasize the RBNZ team’s plan of being data-dependent and keeping its next meetings “alive” for rate hikes.

IF the RBNZ gang sounds more concerned with growth conditions than being hawkish on inflation, then NZD may fall against its counterparts. Short setups against responsive counterparts like USD, JPY, AUD, and CAD makes sense to look at, especially if broad risk sentiment is leaning negative.

But keep in mind that, unless the reaction to RBNZ’s event coincides with overall market sentiment, then NZD’s price reaction could only last until the late Asian session trading.

Also, the Kiwi has had a tough run in recent weeks as signs of NZ economic weakness have hit the wires. This has raised the odds of a potential “buy-the-rumor, sell-the-news” scenario developing around this event, making this event one where waiting for the event outcome and seeing the market reaction before developing a risk management plan.

Alternative Scenario 1: If the RBNZ holds as expected but signals higher concerns of a sticky high inflation environment over the recent dips in economic growth signals, then fundie traders may be drawn into the Kiwi short-term, especially if risk sentiment is leaning positive around the time of release.

NZD may react positively to this scenario, especially if it sees selling pressure heading into the event. Taking a look at the Kiwi against safe havens long makes sense, especially if risk sentiment and/or Chinese data is positive.

Again, keep in mind that overall risk sentiment factors in NZD’s price reaction to RBNZ’s event. If NZD’s initial reaction is against the comdoll’s intraday trend, then consider taking profits before the start of the U.K. or U.S. sessions.

Alternative Scenario 2: An interest change in either direction from the RBNZ is an extremely low probability event outcome at the moment, but if that did play out, the market reaction would likely be directional and heavy in the initial moments after the statement.

Assess the monetary policy statement carefully and if you decide to manage risk, keep in mind that volatility will likely be elevated so keep risk small until the market bias is clear.