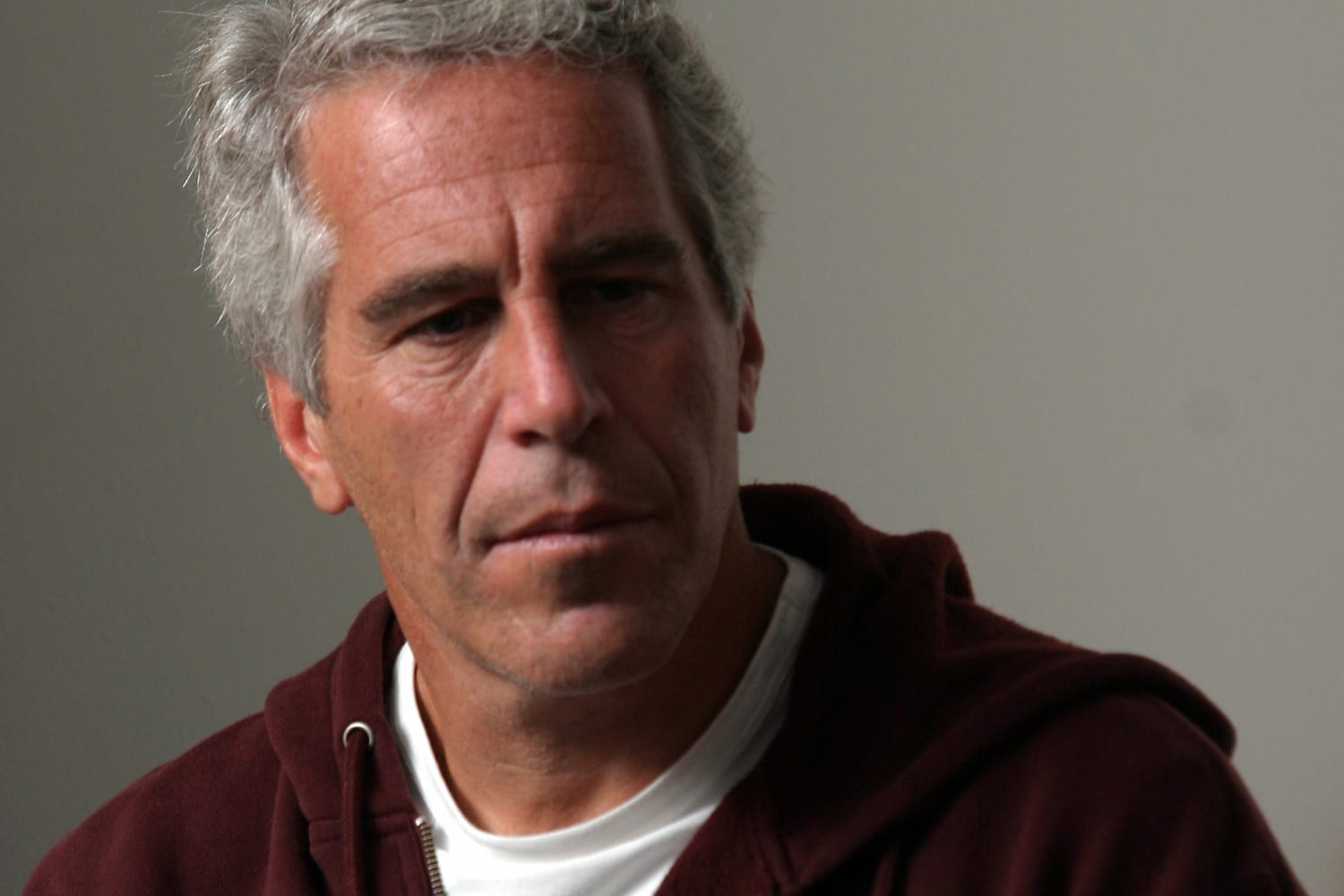

JPMorgan Chase has agreed to settle a lawsuit accusing the Wall Street giant of facilitating disgraced financier Jeffrey Epstein’s sex-trafficking enterprise.

The tentative settlement would resolve a suit that was filed in federal court last year by a woman identified as “Jane Doe 1,” who claimed the financial institution turned a “blind eye” toward Epstein’s conduct. The suit also alleged the bank didn’t comply with federal laws for years while providing services to him and benefiting from his business.

In a joint statement on Monday, the bank and the victim’s lawyers said it reached an “agreement in principle” and “the parties believe this settlement is in the best interests of all parties, especially the survivors who were the victims of Epstein’s terrible abuse.”

“Any association with him was a mistake and we regret it. We would never have continued to do business with him if we believed he was using our bank in any way to help commit heinous crimes,” JPMorgan Chase said in a separate statement.

JPMorgan Chase still faces a similar lawsuit filed in the U.S. Virgin Islands over its ties to Epstein. The convicted sex offender had a residence in the territory. The lawsuit is set to go to trial in October and seeks monetary damages.

Brad Edwards, an attorney for Jane Doe 1, said “the information and support the U.S. Virgin Islands and its legal team provided to the survivors was enormously valuable, and we recognize the importance of the government’s continued litigation against JPMorgan Chase to prevent future crimes.”

The spokesman for the U.S. Virgin Islands Attorney General said they were “gratified to hear about the settlement,” adding the territory “will continue to proceed with its enforcement action to ensure full accountability for JPMorgan’s violations of law and prevent the bank from assisting and profiting from human trafficking in the future.”

The bank is also continuing to litigate its own case against its former JPMorgan Chase executive Jes Staley. The financial institution sued Staley in March, saying he should be held liable for any financial penalties it faces from the lawsuits accusing the bank of enabling Epstein’s conduct.

Source: | This article originally belongs to Nbcnews.com