Who is in for a reversal play?

This double bottom on EUR/GBP looks prime for a breakout in the next few hours!

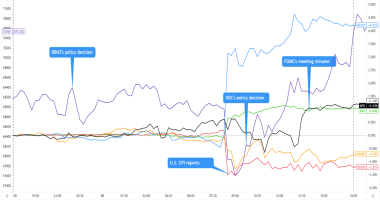

But first, check out the major headlines that Asian session traders have priced in so far:

Upcoming Potential Catalysts on the Economic Calendar:

- German retail sales at 8:00 am GMT

- Swiss CPI at 8:30 am GMT

- Spanish unemployment change at 9:00 am GMT

- Eurozone PPI and unemployment rate at 11:00 am GMT

What to Watch: EUR/GBP

This pair could be due for a reversal from its slide as price formed a double bottom pattern and is now testing its neckline.

Climbing past this ceiling, which is right around the .9000 major psychological mark, could be enough to confirm that an uptrend would follow. Note that the chart pattern spans a little over a hundred pips, so the resulting climb could be of the same height.

There are a few mid-tier reports lined up from the eurozone in the upcoming session, possibly spurring enough volatility for a breakout. Germany has its retail sales figure due, along with the Spanish unemployment change and eurozone PPI numbers.

Just keep in mind, though, that weaker than expected results could lead to another bottom being formed!

Technical indicators are looking mixed, with the moving averages showing a bullish crossover and Stochastic indicating overbought conditions. Whichever direction you choose to play, better take note of the average EUR/GBP volatility when setting entries and exits.