As much as we love booking vacation houses at the beach, paying steep daily rates doesn’t exactly spark joy. But if you’re fortunate enough to own such a place, renting it out short-term can generate substantial revenue.

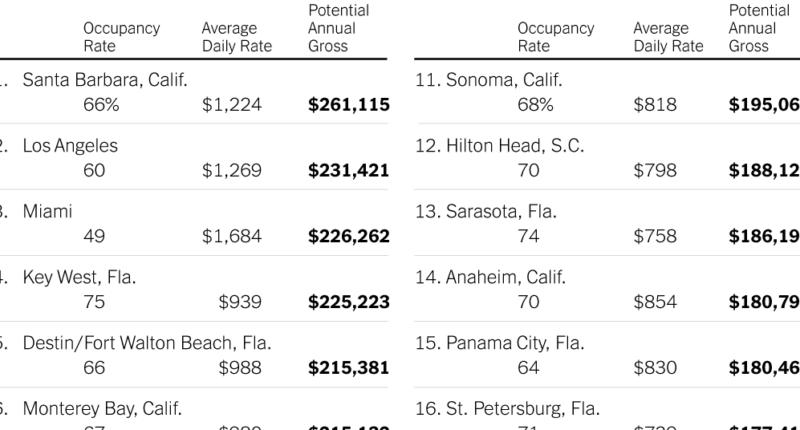

In a recent study, AirDNA, a company that analyzes Airbnb data, found the U.S. vacation rental markets where landlords are likely to see the largest annual profits. Researchers separated the markets for cabins, urban apartments and beach houses, then based the results on occupancy and average daily rates using a year of data from April 2022 through March 2023. Potential gross yearly income was calculated by subtracting Airbnb fees from expected rental payments (though mortgage payments and other expenses were not included in the calculation).

Urban rentals had the lowest potential revenue among the three types of housing. Cabins showed more potential. And large beach homes came out on top. Granted, it’s expensive to buy in expensive markets — as in the top-ranked Santa Barbara, Calif., where an occupancy rate of 66 percent and an average daily rate of $1,224 generated a potential annual gross of $261,115. Los Angeles and Miami followed with similar revenue potential. In fact, 17 of the 20 highest-grossing short-term rental markets for beach houses were found in California or Florida. To determine the profitability of beach houses, only coastal areas of often larger markets were considered.

New York’s Long Island (considered an individual market in the study) ranked 20th for beach houses, no doubt helped by luxury rentals in the Hamptons and other parts of the East End. Long Island’s occupancy rate saw a pandemic bump, from 43 percent in 2019 to 52 percent in 2020, and has hovered around that level since. The average daily rate has risen considerably, from $796 in 2019 to $1,447 in 2023.

Vacation areas on both coasts have shown an uptick in demand this year, which is encouraging for those fortunate enough to own properties. But new owners should be cautioned: The increased risk of severe weather and rising sea levels threatens to cut into that revenue before long.

For weekly email updates on residential real estate news, sign up here.

Source: | This article originally belongs to Nytimes.com