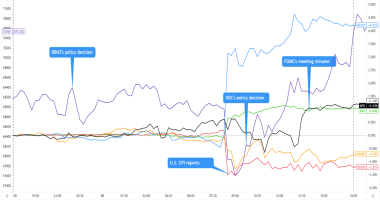

The Kiwi dollar takes the top spot once again this week, moving solidly higher on better-than-expected economic data from New Zealand, as well as positive commentary from monetary and fiscal policy officials.

New Zealand Headlines and Economic data

Monday:

New Zealand Dollar scales 2-yr top as retail recovery shatters records – “The gains came as data showed real retail sales in New Zealand boomed by a record 28% in the third quarter, recovering strongly from an historic 14.6% drop the previous quarter when a strict coronavirus lockdown crippled consumption.”

We saw a broad dip in the Kiwi during the U.S. session with no apparent direct catalyst, but it did correlate with the U.S. dollar’s big bounce after U.S. Flash PMI data gave the markets a big positive surprise (U.S. flash services PMI up from 56.9 to 57.7 vs. 55.8 forecast).

Tuesday:

Finance Minister Grant Robertson asked the RBNZ to include the housing market in its mandate, a significant step in the Government’s quest to address soaring house prices – “REINZ has reported that there has been a 20 per cent year-on-year increase in house prices and the Government has come under enormous pressure to cool the market down.” Kiwi dollar bulls reacted positively to this news, likely on the idea that the RBNZ will have to take action on interest rates to reduce the demand for home loans.

Wednesday:

RBNZ: New Zealand’s Economy Relatively Resilient to Pandemic Shock

RBNZ Financial Stability Report for November 2020

- Fiscal and monetary support have prevented a substantial rise in unemployment

- Significant downside risks remain, and some sectors will face continued stress.

- We intend to reinstate LVR restrictions to manage risks from high-risk housing lending.

NZ central bank to tighten mortgage lending as prospects for negative rates dim

Thursday:

New Zealand posts ‘mammoth’ annual trade surplus, biggest since the 1990s

- “New Zealand benefited from the trade of goods to the tune of $2.2 billion in the year to the end of October”

- “Imports are down in part because of restrictions on international and domestic travel imposed in March to slow the spread of the pandemic. That can be seen in the big drops in annual imports of things like turbojets, fuel, and cars” – NZ international trade manager Alasdair Allen

Friday:

The Kiwi dollar began to continued its march higher on Friday, without apparent catalysts from New Zealand. It’s likely a technical continuation of the week’s gains, but it may have also stemmed from positive risk sentiment sparked by news from China that industrial profits grew at the quickest monthly pace since early 2017.