ECB easing expectations drove the euro lower last week, and the upcoming PMI releases could add fuel to the fire.

Here’s what market watchers are expecting.

Eurozone PMIs (Nov. 23, starting 9:15 am GMT)

- French flash services PMI to fall from 46.5 to 39.2 this month

- French flash manufacturing PMI to slip from 51.3 to 50.2

- German flash services PMI to fall from 49.5 to 46.1 in November

- German flash manufacturing PMI to drop from 58.2 to 56.0

- Eurozone flash services PMI to decline from 46.9 to 42.2

- Eurozone flash manufacturing PMI to slip from 54.8 to 53.2

- Readings below 50.0 reflect industry contraction, above 50.0 reflects expansion

- Sharper than expected declines could mean more losses for the shared currency as these could confirm easing speculations

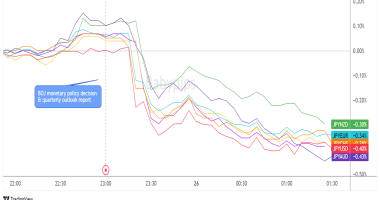

Overall market sentiment

- Increased focus on coronavirus cases and lockdown measures could spur demand for safe-haven lower-yielding currencies like the Swiss franc

- France and Spain are reporting a slower pace of daily cases while Germany and Italy are still struggling to contain the virus

- EU and U.K. officials are expected to finalize the Brexit deal this week, which could bring a relief rally for European currencies

Technical snapshot

- Stochastic reveals that EUR/NZD is bullish while EUR/USD and EUR/CHF are looking bearish in the overbought zone

- The same oscillator puts AUD/CHF and NZD/CHF in the overbought zone while giving off bullish vibes for CHF/JPY

- CHF was most volatile against NZD, CAD, and AUD in the last seven days

Missed last week’s price action? Read EUR & CHF’s price recap for Nov. 16 – 20!

This post first appeared on babypips.com