Anyone buying a ticket for a concert, baseball game, Broadway play or flight has experienced it: Seats are now priced with dizzying complexity, with costs in some instances changing minute by minute, based on demand.

But movie theaters? In many ways, they have been trapped in pricing amber. A seat has cost the same no matter where it is or when it is bought.

No more.

As they struggle in a fast-changing business, multiplex operators — some carrying astounding debt because of pandemic shutdowns — have started to experiment with pricing in ways that have startled moviegoers. AMC Entertainment, the world’s largest cinema chain, is testing “sightline” pricing, giving seats at evening screenings different costs depending on their location. (Discounts of $1 to $2 for the neck-craning front row, increases of $1 to $2 for the center middle, status quo for the rest.) Chains have also started to charge more on opening weekends for expected blockbusters like “The Batman” and “Spider-Man: No Way Home,” with plans to ramp up the practice.

“It’s a taste of what’s coming,” said Stacy Spikes, who co-founded the subscription ticketing service MoviePass, which he plans to reintroduce nationwide this summer. “The big theater chains are gaining the technology to implement variable pricing on a wide scale. This may have near-term financial benefits, but it may also reduce attendance of younger customers who are more price sensitive and key to future growth.”

Increasingly, theaters have been pushing customers toward premium-priced specialty tickets. On Saturday evening at AMC Lincoln Square in New York, for instance, patrons interested in the boxing drama “Creed III” could choose from three IMAX screenings (a $7 to $11 surcharge, depending on seat location), three screenings with Dolby audio and visual technology and reclining chairs ($8 to $12 more), and two standard screenings ($18 for a regular adult ticket).

“I’m going to go, no matter what, because I love it, but sorting through all the options is starting to feel like a nuisance,” said Chris Ordal, a tech executive in Los Angeles. “I understand why chains are doing this, but they’re not doing a good job of communicating how it helps the consumer.”

The move toward pricing complexity adds risk as theater owners look for ways to get people back into the ticket-buying habit after three pandemic-battered years. IMAX has been experimenting with live events, including concert simulcasts. Fathom Events has premiered episodes of a religious TV show, “The Chosen,” in theaters; episodes have generated $20 million at the box office since November, despite being available free online.

Prices may actually be going down for certain types of movies — ones that have struggled to attract ticket buyers in the streaming age, including comedies, conventional dramas and art films. Last month, theaters lowered opening-weekend prices for the octogenarian comedy “80 for Brady” to attract value-sensitive older customers. Tickets for evening screenings cost the same as a matinee, a discount of up to 30 percent, depending on the location. Some theaters offered the same deal for “A Man Called Otto,” starring Tom Hanks.

“In a business where the only innovation in pricing has been to go up, this is a good first step,” said Chris Aronson, the president of domestic distribution at Paramount Pictures, which released “80 for Brady” and urged theaters to lower prices.

Inside the Media Industry

- Rupert Murdoch: The conservative media mogul acknowledged in a deposition in a $1.6 billion defamation lawsuit that several Fox News hosts promoted the false narrative that the 2020 election was stolen.

- Dropping ‘Dilbert’: Hundreds of newspapers across the country will stop running the comic strip after its creator, Scott Adams, said that Black people were “a hate group.”

- Carlos Watson: The founder of the troubled digital start-up Ozy Media was arrested on fraud charges, punctuating one of the more precipitous falls in the annals of online journalism.

- Vice Media: The departure of Nancy Dubuc, the chief executive of Vice, highlights the fallen fortunes of a group of digital media companies that not long ago was talked about as the future of the industry.

“We’re hopeful that others will follow,” Mr. Aronson added, “and that this is hopefully the beginning of alternative ways of looking at pricing.” (Antitrust rules prevent studios from setting ticket prices themselves.)

Paramount spent about $28 million to make “80 for Brady,” which has so far collected about $40 million. Roughly 15 percent of the film’s target audience, women over 50, had not been to a theater in more than a year, according to exit surveys.

Charging less for certain kinds of movies and more for others has long been a Hollywood third rail, with filmmakers panicking that it will send a message about quality. Just try telling Martin Scorsese that tickets for his next prestige drama will cost less than ones for “Ant-Man and the Wasp: Quantumania.”

The difference now is that the theatrical marketplace has become so difficult for certain genres that many filmmakers may have no choice. Do you want your film to be seen in theaters? Or are you fine with it going straight to streaming, where it could get lost in the digital maw? If the answer is theaters, you may have to accept a discounted price.

The average movie ticket cost $11.75 in 2022, according to EntTelligence, a research firm. In New York, prices reach $28, depending on the format. A small popcorn at AMC Lincoln Square costs $10 with tax. (Fun fact: The average movie ticket price in 1969 was $1.42, according to the National Association of Theatre Owners. Adjusted for inflation, that ticket would cost $11.93 today.)

Because multiplex chains make most of their money from popcorn and soda, it is in their economic interest to keep ticket prices low; concession counters rely on foot traffic. But there isn’t much room to raise the price of popcorn anymore, prompting some operators to look at “creative” ticket pricing for growth.

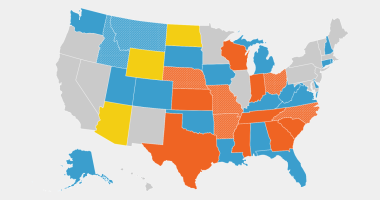

Cinema attendance had been declining for decades, with people citing a variety of reasons for going less often: 50-inch TVs at home, streaming services, rude patrons who text on their phones when the lights go down. But the pandemic caused ticket sales to collapse in 2020 and 2021. More than 500 movie screens have closed since the start of the pandemic. Cineworld, the world’s No. 2 chain, filed for bankruptcy in September, and dozens of its Regal multiplexes in the United States have closed.

A recovery has been slower than expected. Cinemas in North America sold $7.5 billion in tickets in 2022, a 34 percent decrease from 2019, according to EntTelligence. This year, domestic ticket sales are running 24 percent behind the same period in 2019, according to Comscore.

The gap is expected to narrow this summer, largely because the flow of new movies is normalizing. Movies delayed by pandemic bottlenecks are finally ready. Studios are also rerouting fewer movies to streaming services. Twelve movies costing at least $100 million to make will arrive in theaters from May to July, up from six during that period last year.

“If you squint hard enough, it is possible now to see a return to the better days,” Robert Fishman, an analyst at SVB MoffettNathanson who follows the Cinemark multiplex chain.

Cinemark has comparatively little debt, but the hole for other theater companies is deep. AMC, which according to security filings has more than $5 billion in debt, said last week that it generated $990 million in the fourth quarter of last year, a 15 percent decline from 2021, and lost about $288 million.

To shore itself up, AMC has offered $5 movie tickets on Tuesdays, introduced home popcorn products in partnership with Walmart, enhanced its Stubs loyalty program, announced plans to turn some theaters into Zoom conference rooms for corporate events and invested in a struggling Nevada gold mine. (Yes, really.) Last month, AMC announced its pricing experiment with seat location, which it calls Sightline.

Adam Aron, AMC’s chief executive, characterized that move — charging a bit more for the best seats — as less a moneymaking gambit than a way to avoid broader price increases.

“In these inflationary times, we are coming under pressure to raise prices,” Mr. Aron said in an interview. “We could have raised prices on every seat in the house. Instead, we are holding the line on 75 percent of the seats in the house.” (Also, subscribers to AMC’s premium loyalty program, Stubs A-List, can book a “preferred” seat at no extra charge.)

Wall Street responded favorably. But cinephiles had a conniption. In a column, The Chicago Tribune’s film critic, Michael Phillips, called Sightline “a bush-league pickpocket move” and “the latest tiny nail getting tap-tap-tapped into the coffin currently under construction for an entire era of filmgoing.”

AMC has pushed back, noting that some European cinemas have charged a premium for prime seats for years. Yes, prices are high in New York and Los Angeles, Mr. Aron acknowledged. But he said 30 percent of AMC customers paid less than $8 a ticket.

“When you change the way an industry has priced itself for 100 years, it is not surprising that there is going to be lots of reaction,” Mr. Aron said. “It is our expectation that consumers will adjust to this very quickly.”

Source: | This article originally belongs to Nytimes.com