Who will be impacted by the change?

Every person has their own unique earnings threshold depending on their circumstances.

But, as a rough example, before, if you were single, employed and had household earnings of more than £494 per month you were not expected to look for or be available for work.

This was £782 per month joint income if you are part of a couple.

But these figures were up to £617 and £988 respectively from today.

If you earn under these amounts you will have to look for or be available for work.

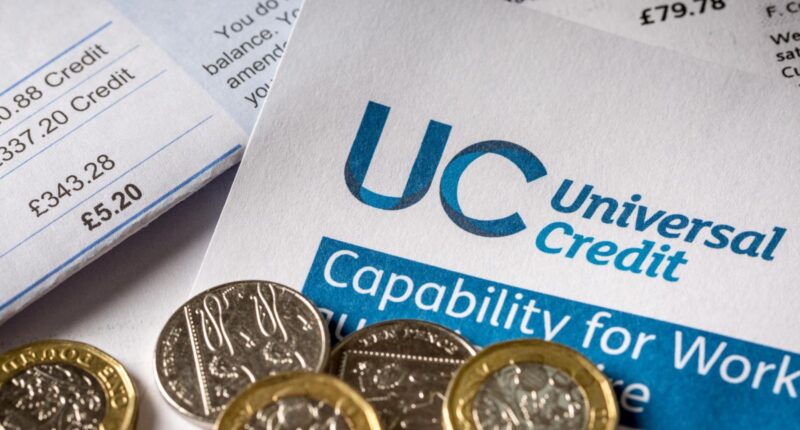

But there are some exceptions, for example if you have a joint Universal Credit claim and your partner is not expected to work because they have a Limited Capability for Work.

Another exception is if you are over the state pension age, which is currently 66.

The rules can be complicated so it’s worth talking to your work coach who can help guide you on the change.

Charities like Turn2Us are useful for advice too. You can call them for free on 0808 802 2000.