WASHINGTON — Despite White House efforts to provide some relief to student loan borrowers, those arriving on campus this fall are being financially squeezed by higher college costs and rising interest rates that make it more expensive to borrow money to cover those expenses.

Students looking to take out new federal loans will have to pay an extra $1,200 for each $10,000 they borrow over 10 years after interest rates rose to 5% from 2.75% two years ago, according to an NBC News estimate. Loans from private banks have gone up even faster, with some charging more than 13% for student loans this fall, people familiar with the industry said. Borrowers with existing loans that have variable rates have started seeing their monthly payments go up from the higher rates, they said.

Some student loan advisers anticipate the rates for both federal and private loans will shoot up even more next year as a result of the Federal Reserve raising rates to try to cool decades-high inflation.

“Borrowers going into the future need to be aware that rates are probably going to take a significant jump next year,” said Robert Farrington, founder of The College Investor, which advises student loan borrowers. “I think we’re going to see those rates jump at least another 1% to 2% come next school year, which is really going to increase the costs for borrowers.”

The higher cost of borrowing for college comes as tuition has increased by an average of 3% to 5% this fall, according to research by Fitch Ratings, a credit rating company, and as inflation has increased the cost of essential items such as food and housing.

Increased costs mean many students have to borrow more money at higher rates, further exacerbating the student debt problem the Biden administration set out to address.

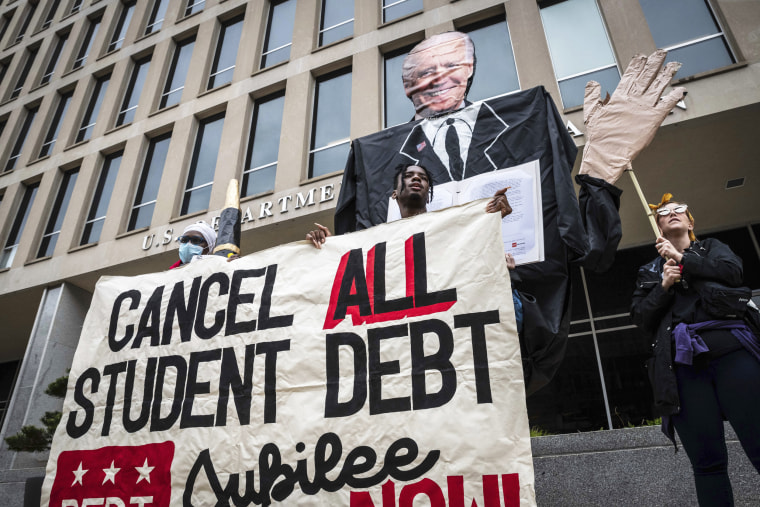

Biden announced last month that he would forgive $10,000 in federal student loans for individuals who made less than $125,000 a year in 2020 or 2021, or $250,000 for couples who file taxes jointly. He also said Pell Grant recipients, who make up the majority of student loan borrowers, would be eligible for an additional $10,000 in debt relief, for a total of $20,000, and he proposed new programs that would cap how much of their income borrowers would have to pay each month toward their federal loans.

But Biden made it clear that the debt cancellation was a one-time event and his plan did not address the underlying issue around the rising cost of college, offering less benefit for incoming students who won’t be eligible for loan forgiveness for the money they are taking out to pay for tuition this fall and beyond.

The White House did not respond to requests for comment.

“They’ve really done things to address some of the most vulnerable borrowers out there, and I don’t want to take any of that away from them, but the frustrating part is the problem isn’t student loans — student loans is a symptom. The problem is the cost of higher education,” said Betsy Mayotte, president of The Institute of Student Loan Advisors. “So what’s been frustrating me is that there hasn’t been a more robust conversation about fixing the actual problem.”

Biden, who also extended the pause on federal student loan payments for a final time through Dec. 31., had been pressured for months by Democrats and advocacy groups to use his presidential authority to cancel student debt. Although the president made clear in his announcement that the cost of higher education was way too high, his administration has not taken concrete action to address rising tuition.

“We commend this administration for responding to the call of addressing of the student loan debt crisis,” said Derrick Johnson, president of the NAACP. “However, with rising interest rates and potentially another increase in interest in November, we are also witnessing a sharp increase in the cost to go to college.”

Hannah Appel, a co-founder of the Debt Collective, a union of borrowers who have fought for widespread student loan cancellation, and a professor of anthropology at UCLA, said that “$20,000 in student debt relief doesn’t go far enough, leaving millions of debtors with high balances out to dry and doing nothing for future students.”

“The root cause of student debt is ballooning tuition, which households are forced to finance through debt,” she said, adding that Debt Collective would continue to advocate for “full student debt abolition and free college for all.”

In the face of high inflation, rising costs and labor shortages, colleges are facing their own financial pressures, said Emily Wadhwani, a senior director at Fitch Ratings.

Although tuitions are rising by as much as 5%, that’s still not enough to keep up with the roughly 8% inflation that is jacking up the price of everything from electricity to school supplies. And declines in the stock market mean that some institutions will have less income generated from their endowments.

“Cash is strapped right now, both for students and for universities,” said Wadhwani.

While some colleges might hesitate to raise tuition enough to keep up with inflation out of concern that their enrollment numbers could decline, Farrington said that many institutions will pass those costs on to students.

“This is just going to continue to trickle upward where students are going to be paying more for those education costs and everything that comes through that pipeline at the end of the day,” he said.

Source: | This article originally belongs to Nbcnews.com